Suits Me Card

SUITS ME MASTERCARD

Personal Account with Contactless Functionality and Cashback Rewards

Join thousands of people already changing their lives.

Suits Me accounts are designed to suit you and have all the features you will need to manage your money.

It suits customers as they are quick to open, easy to use and so many extras as standard. Suits Me accounts can help you to budget and manage your money. There are no minimum deposits, overdrafts or unauthorised fees, and you can earn extra money with our cashback and discount partners.

Contactless debit card

Choose your Suits Me account type and you will get a free delivery of your contactless Mastercard® debit card by first class post. Many of our customers receive this the next day.

Your contactless card allows you to use it anywhere you go. Just search for the contactless symbol.

![]()

You can apply for a Suits Me Card Account by clicking the 'Apply Here' Link Below or scanning the QR Code.

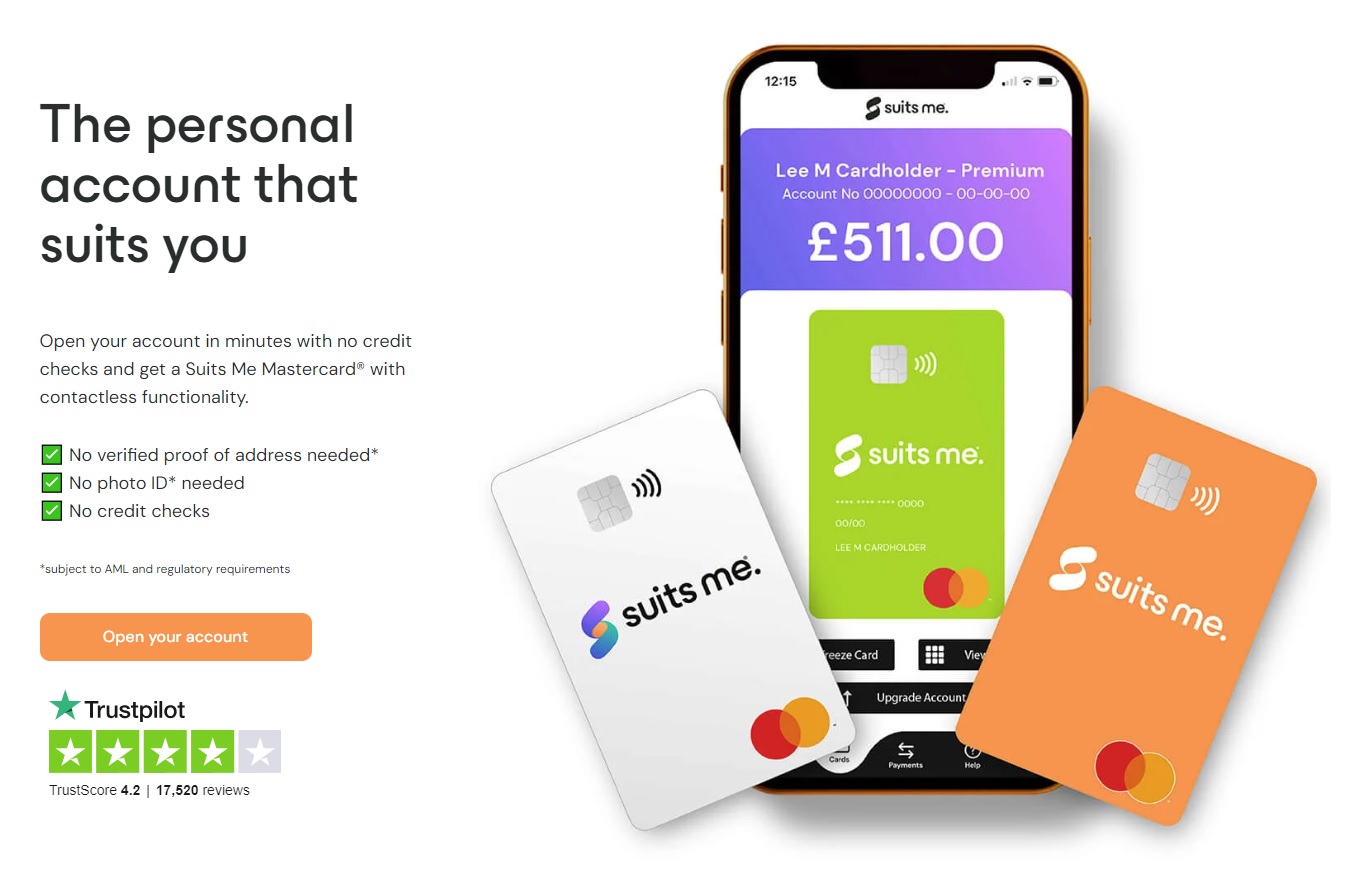

Open your account in minutes with no credit checks and get a Suits Me Mastercard® with contactless functionality.

✅ No verified proof of address needed*

✅ No photo ID* needed

✅ No credit checks

*subject to AML and regulatory requirements

Suits Me Terms & Conditions can be found by clicking the link below:

Easy to use mobile app

It’s easy to check your account balance, add Payees, make Faster Payments and get instant notifications on spending and deposits to your account. You can also retrieve your PIN if you forget it and report your debit card as lost or stolen.

Our secure mobile app is the perfect way to manage your finances on the go, from the convenience of your smartphone.

Download on the Apple App Store or Google Play

Service with a Smile

We have a multi-lingual Customer Care team to help you with your account if you ever need help. With your own dedicated customer account manager who understands your account needs and who you can talk to face to face through our virtual branch-like video call service.

We are available 9am – 8pm Monday to Friday on email and phone.

We’re here to make sure you can manage your money, whatever your lifestyle.

Customer Services

Contact Details

03330 151 858

hello@suitsmecard.com

(Calls to 03330 151 858 cost your standard network rate)

Fast payments and transfers

Receive and send money in the UK and send money abroad easily, with money being available within hours of transfer.

There are lots of ways to add funds to your card and access your money. Have your wages or benefits sent directly to your account, send a Faster Payment or cash top up at any PayPoint store. You can use your card online, in-store and at any ATM machine globally. You can pay Direct Debits and set up standing orders from your account.

Unlimited cashback

Save money when you use your Suits Me card in our partner retail stores or when you shop online. You’ll get cashback back into your Suits Me account.

Some of our cashback partners include Argos, Asda, B&Q, Goldsmiths, Halfords, Footlocker, New Look, Sainsbury’s and more.